Aging and Estate Planning go hand in hand. Imagine: You’ve worked hard your entire life. You’ve built a home, raised your family, and accumulated assets that represent decades of sacrifice and smart decisions. But here’s something most people don’t realize: without an estate plan, all of that could unravel in ways you never imagined.

The truth is, growing older without an estate plan doesn’t just affect you: it creates a web of hidden risks that can devastate your loved ones long after you’re gone. Let me share what really happens when families face these challenges unprepared.

When the State Decides Your Legacy

Imagine this: Sarah, a 68-year-old widow, passed away suddenly without a will. She always meant to “get around to it” but kept putting it off. Sarah had two children: one who had been her caregiver for years, and another who had been estranged from the family for over a decade.

Without an estate plan, the state’s intestate succession laws kicked in. The estranged child received half of everything, despite Sarah’s clear intentions during her lifetime that her caregiver daughter should inherit the family home. The caring daughter, who had sacrificed her own career to care for her mother, was forced to sell the home she’d grown up in just to buy out her sibling’s share.

This isn’t a rare story: it happens every day across America. When you don’t have an estate plan, you’re not making a choice to let things “work themselves out.” You’re choosing to let the government decide who gets what.

The Nightmare of Incapacitation Without Protection

Here’s a risk that’s even more immediate than death: what happens if you become unable to make decisions for yourself? Without a durable power of attorney and healthcare directives, your family faces an impossible situation.

Consider Tom, age 72, who suffered a stroke that left him unable to communicate clearly. He had no estate planning documents. His adult children couldn’t access his bank accounts to pay his bills, couldn’t make medical decisions on his behalf, and couldn’t even get information from his doctors about his condition.

The family had to go to court to get guardianship/conservatorship: a process that took three months, cost over $15,000 in legal fees, and required them to report to the court every year about Tom’s care and finances. Meanwhile, bills went unpaid, his credit suffered, and the family was in constant stress about making the right medical decisions without knowing his wishes.

Your Children’s Future Hangs in the Balance

If you’re a parent, this next risk should keep you up at night. Without an estate plan, you have zero control over who raises your children if something happens to both parents.

The courts will decide based on what they think is “in the best interest of the child,” but they don’t know your family dynamics, your values, or your children’s needs. They might place your kids with relatives who don’t share your beliefs about education, discipline, or even basic lifestyle choices.

Even worse, without proper planning, your children’s inheritance could be handed to them as a lump sum at age 18. Think about that: would you have made smart financial decisions with a large inheritance at 18? Many families watch their life’s work disappear within months when unprepared young adults suddenly have access to significant money.

The Probate Maze: Expensive, Public, and Endless

When you die without an estate plan, your family doesn’t just grieve: they get thrown into the probate system. This isn’t the simple “reading of the will” you see in movies. Probate is a lengthy court process that can take 18 months or more, costs thousands of dollars in fees, and makes all your private family business part of public records.

During probate, your family can’t access most of your assets. They can’t sell your house, can’t access investment accounts, and may struggle to pay ongoing expenses. Meanwhile, court fees, attorney costs, and other expenses eat away at the inheritance you worked so hard to build.

And here’s something most people don’t realize: probate records are public. Anyone can walk into the courthouse and see exactly what assets you had, who your beneficiaries are, and what debts you owed. For your family, this loss of privacy can be devastating.

When Good Intentions Lead to Financial Disaster

Maybe you think your family will “figure it out” and handle your assets responsibly. But without proper planning structures like trusts, there’s no protection against poor financial decisions, creditors, or family conflicts.

I’ve seen inherited businesses destroyed because siblings couldn’t agree on management decisions. I’ve watched vacation homes that held generations of family memories get sold because the costs became unmanageable and there was no plan for shared ownership. Family heirlooms, photo collections, and sentimental items often become sources of bitter disputes when there’s no clear guidance about who should receive what.

The Charitable Gifts That Never Happen

Throughout your life, you’ve probably supported causes you care about. Maybe you’ve always planned to leave something to your church, your alma mater, or a charity close to your heart. Without an estate plan, those good intentions remain just that: intentions.

The organizations that meant something to you will never benefit from your generosity, and your legacy of giving dies with you. Meanwhile, distant relatives you barely know might inherit assets you would have preferred to use for meaningful purposes.

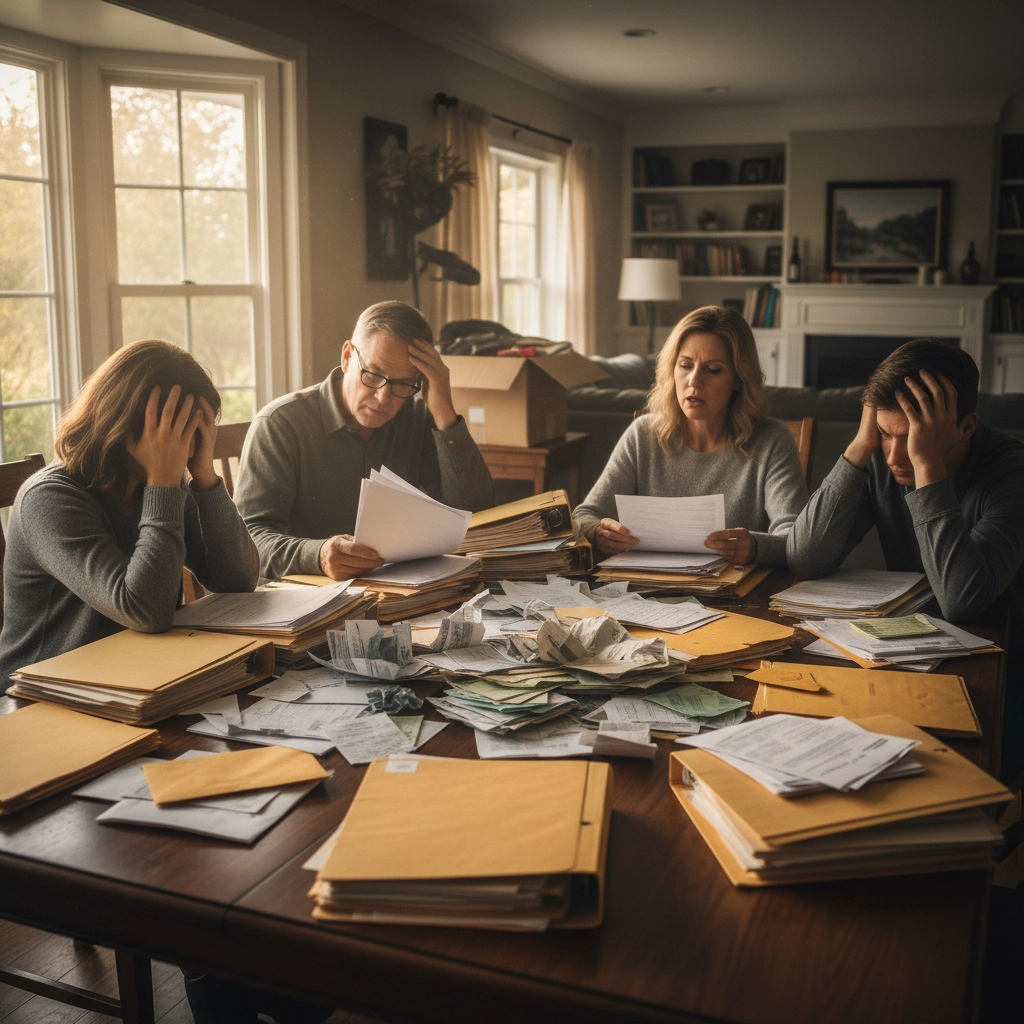

Your Family Pays the Hidden Costs

Beyond the financial expenses, growing older without an estate plan imposes crushing emotional costs on your family. When people are grieving, they shouldn’t have to navigate complex legal systems, make difficult decisions without guidance, or fight with relatives over unclear intentions.

Your loved ones will spend months or even years dealing with the mess instead of celebrating your life and moving forward with their own. They’ll hire attorneys, appear in court, and make decisions under stress that could have been handled calmly during your lifetime.

The worst part? They’ll always wonder if they’re doing what you would have wanted. That uncertainty and guilt can haunt families for years.

The High Cost of Procrastination

Here’s what happens when people keep putting off estate planning: the risks compound over time. The older you get without a plan, the more likely you are to face incapacitation before you can complete your planning. Health issues might make it more difficult to execute documents properly, or family members might question your mental capacity if you try to create plans during a health crisis.

Meanwhile, your assets may grow in value, making the potential consequences of poor planning even more severe. Tax planning opportunities are missed, and family dynamics may become more complex over time.

Taking Control: It’s Not Too Late

The good news is that every single one of these risks is completely preventable. A comprehensive estate plan gives you control over every aspect of your legacy: from who inherits your assets to who makes decisions if you can’t, from how your children are raised to which charities benefit from your generosity.

Estate planning isn’t just about death: it’s about protecting your family during the most vulnerable times of their lives. It’s about ensuring your values continue to guide your family’s decisions even when you’re not there to make them yourself.

The process is more straightforward than most people think, and the peace of mind it provides is invaluable. Your family deserves to know exactly what you want and to have the legal tools to carry out your wishes without conflict, delay, or unnecessary expense.

Your Next Step

Don’t let another day pass without protecting your family’s future. The hidden risks of growing older without an estate plan are too serious to ignore, and the solution is within your reach.

Take action today. Your loved ones are counting on you to make the difficult decisions now so they don’t have to make them during their darkest hours. Visit personallegacylawyer.com to learn more about how proper estate planning can protect everything you’ve worked to build.

Ready to get started? Call 855-965-3666 or schedule a free 15-minute consultation at https://personallegacylawyer.as.me/schedule/6d7ffe2d. Don’t wait: your family’s future security depends on the decisions you make today.